Friday’s issue of the New York Times has an article about the pending problems with the Federal Housing Administration (FHA).(1) For those of you who read this blog that is old news. But it is just the tip of the housing iceberg. The real danger lies within the Government Sponsored Enterprises (GSEs).

The Federal National Mortgage Association was part of the FHA until 1968 when, under mounting budget pressures brought on by his policy of “guns and butter,” President Lyndon Johnson privatized Fannie Mae taking it off the federal government’s balance sheet. Unfortunately he didn’t disconnect it from the government’s guarantee. Two years later the Federal Home Loan Mortgage Corporation, later known as Freddie Mac, was formed to “compete” with Fannie Mae. Both became public companies and were two of the largest companies in the Fortune 500.

Initially both GSEs operated like great big savings and loans borrowing from the public and purchasing mortgages for their portfolios. In addition to the implied government guarantee the GSEs were exempt from state and federal income tax and, unlike any other companies in the Fortune 500, were not required to report potential financial difficulties in their annual filings. In the early 1980s Fannie Mae faced bankruptcy because of a mismatch between assets and liabilities and a surge in foreclosures. Losing $1 million a day, by 1983 its net worth had fallen below zero. But the government came to the rescue and under an accounting change sponsored by then President Regan, both Fannie and Freddie were able to capitalize the losses on their portfolio loans, some worth only seventy cents on the dollar, sell the loans as mortgage backed securities and amortize the loss over the next 20 to 30 years. This policy, called “forbearance” allowed the lenders to operate with negative net worth. Fannie president David Maxwell increased lending standards and moved the portfolio into adjustable loans to reduce the sensitivity to short term borrowing costs.(2) The sensitivity between assets and liabilities improved as both GSEs extended the maturities by issuing longer term debt and securitizing and selling many of their loans. As the yield curve steepened Fannie recovered but the same fate that befell Fannie Mae hit the savings and loan industry leading to the failure of over 740 institutions at a cost to the taxpayer of $124 billion.(3)

Not content to let the mere subsidization of housing rest with the benefits already bestowed on Fannie and Freddie successive congresses and administrations pressed their own agendas on the agencies. The profits of Fannie and Freddie were ripe for use as subsidies to the under-served segment of the market, the euphemism for low to moderate income home buyers. The Federal Home Loan Mortgage Corporation Act updated Freddie’s charter in 2005, “to provide ongoing assistance to the secondary market for residential mortgages (including activities relating to mortgages on housing for low- and moderate-income families involving a reasonable economic return that may be less than the return earned on other activities)…”(4) Much of this subsidy was provided to bring in the very borrowers who today cannot afford the homes they were encouraged to buy.

And then came the Great Panic of 2008. With the future financing of the GSEs very much in doubt the Bush administration released a proposal that would temporarily authorize the Department of the Treasury to purchase $100 billion each, up from $2.25 billion, of Fannie Mae and Freddie Mac obligations. At the time the CBO estimated the chance of this occurring at less than 50% and “that the expected value of the federal budgetary cost from enacting this proposal would be $25 billion over fiscal years 2009 and 2010.” The CBO assigned only a 5% probability the price tag would reach $100 billion between them. On September 7, 2008 Fannie Mae and Freddie Mac became wards of the U. S Government. At the end of March, 2008 the combined portfolio of mortgage loans and guarantees of the GSEs stood at $5.2 trillion(5) and by July 2009 the bailout was fast approaching that $100 billion mark. Mortgage analyst Bose George of Keefe, Bruyette & Woods said, “We’re assuming they each will cross the $100 billion mark fairly soon.”(6)

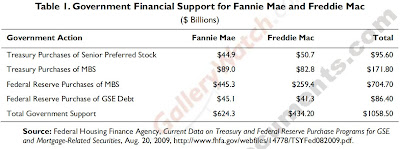

Today the picture is only bleaker. Losses continue to mount. Renegotiated loans are re-defaulting at a rate in excess of 50%(7) and the default rate on the current portfolio is approaching 10%. On September 9, 2009 the Congressional Research Service released a report entitled “Options to Restructure Fannie Mae and Freddie Mac”.(8) The table below from that report shows that total taxpayer support for Fannie and Freddie now stands at $1.058 trillion dollars.

In a recent interview Rep. Barney Frank (D-Mass.) responding to a question of becoming Secretary of Housing and Urban Development said, “I want at least two years with President Obama and a solidly Democratic Senate so that we can get the federal government back in the housing business.” With the government insuring 90% of current home loan activity I am having a real tough time finding what’s left for the government to "get...back in..."

And see the debt ticker to the right of this blog? Add the $5.2 trillion of debt guaranteed by the GSEs that isn’t yet shown on the government’s balance sheet. Including the GSEs government debt now stands at a mind-boggling 122% of GDP. There are only three countries in the world with a higher percentage; Lebanon, Japan and Zimbabwe.(9) I wonder which one we are aspiring to?

____________________________________

(1) http://www.nytimes.com/2009/10/09/business/09fha.html?_r=1&th&emc=th

(2) “Getting Fannie Mae in Shape” NY Times, December 26, 1985

(3) http://en.wikipedia.org/wiki/Savings_and_loan_crisis

(4) Federal Home Loan Mortgage Corporation Act, 12 U.S.C. Sec. 1451 Note. Sec. 301(b)3.

(5) CBO Report to the Committee on the Budget, U. S. House of Representatives by Peter R. Orszag, CBO Director, July 22, 2008

(6) http://money.cnn.com/2009/07/22/news/companies/fannie_freddie_bailout/

(7) http://finance.yahoo.com/news/Homeowners-in-financial-apf-1726904164.html?x=0&sec=topStories&pos=6&asset=&ccode

(8) Options to Restructure Fannie Mae and Freddie Mac, N. Eric Weiss, September 9, 2009

(9) https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html

No comments:

Post a Comment