In November of 2000 the U. S. Treasury and the International Monetary Fund together provided $18 billion to bail out Argentina. The economy had collapsed and Argentina was on the verge of defaulting on its debt. In exchange the government agreed to austerity measures; spending cuts, deregulation of their pension system and tax hikes. At the time a retired Argentinean was quoted, “We can’t go on living like this. The government promised us change, but all it has done is deepen the problems of those most in need.”

In November of 2000 the U. S. Treasury and the International Monetary Fund together provided $18 billion to bail out Argentina. The economy had collapsed and Argentina was on the verge of defaulting on its debt. In exchange the government agreed to austerity measures; spending cuts, deregulation of their pension system and tax hikes. At the time a retired Argentinean was quoted, “We can’t go on living like this. The government promised us change, but all it has done is deepen the problems of those most in need.”By December 2001 Argentina was back. The IMF refused to provide another round of funding and, in 2002 Argentina became the largest default in world history. The renegotiation process extended from the default through 2005 ultimately costing the world $137 billion.

The Argentinean default was preceded by ten years of lending by U. S. banks and the IMF culminating in the 2000 bailout. Beginning in 1991 re-negotiations followed in 1992, 1996 and 1998. But after failing to get new funding public debt exploded from 63% of GDP to 150% from December 2001 until the 2002 default.

For the last century America has used its balance sheet to effect its policies around the world. The Bretton Woods monetary system in 1945 created the IMF dominated by the United States, then the financial powerhouse of the world. The IMF became an extension of the U. S. financial system. In 1971 the United States defaulted on its obligations to the IMF and the world by unilaterally removing the dollar from gold convertibility and establishing the paper dollar as the world reserve currency.

American hegemony started under Woodrow Wilson when the New York banks, led by the House of Morgan, financed the allied powers against Germany. It continued into the 21st century to finally be undone by America’s entry into its own financed war with Iraq. That war and the attendant policies of the Federal Reserve and Congress set the stage for the 2008 financial collapse.

The irony is the very same banks that launched a century of ever expanding leverage, who were complicit with government in bringing on the 2008 collapse are now the biggest beneficiaries of government policies to assuage the pain.

The slow motion unraveling of the European debt crisis looks like a replay of Argentina and a prelude of what could easily occur here in the United States over the next ten years.

China has replaced the U. S. as the leading financial power in the world. With a $2.7 trillion International Investment Fund, China's fund dwarfs the balance sheet of the IMF which stands at 240 billion Special Drawing Rights (SDRs), equivalent to approximately $370 billion.

And now China has stepped into the EU crisis with an offer of aid.

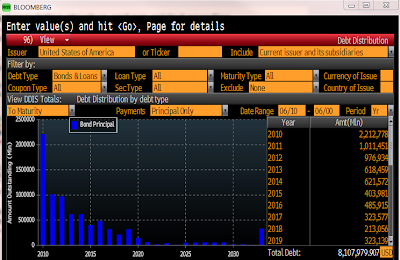

The United States today looks like a third world country. On October 30, 2010, the end of our fiscal year, total debt stood at $13.5 trillion versus a $14.7 trillion GDP. That doesn’t include $3.2 trillion owed by Fannie Mae and $2.3 trillion by Freddie Mac.

In March 2010 Congressman Barney Frank claimed the two agencies obligations are not sovereign debt. If not why did Treasury spokeswoman Meg Reilly only one month earlier reiterate, "As we said in December, there should be no uncertainty about Treasury's commitment to support Fannie Mae and Freddie Mac as they continue to play a vital role in the housing market."

As the Treasury continues to pour hundreds of billions of taxpayer dollars into the two agencies it would be fair to ask, “Is it or isn’t it?” If it is, total sovereign debt guarantees today stand at 130% of US GDP growing at over $1 trillion per year.

The actual operating deficit in the U. S. for the fiscal year ending in October 2010 was over $2 trillion. Inter-agency transfers reduced that number to $1.2 trillion. And none of this recognizes a $30 trillion unfunded liability for the Social Security Trust Fund nor the cost of the new health care bill.

Over the years each time U. S. banks and the IMF provided funding for a failing government they extracted promises. Those promises uniformly included reduction of public expenditures on entitlements and operating budgets, increases in taxes, requirements to open markets and agreements to stabilize their currencies, usually with some sort of peg. For the lenders, getting paid back in a worthless currency is almost as big a risk as not getting paid back at all.

So as China flirts with bailouts for the EU nations it is worth noting the EU is extracting exactly those same commitments from its client states. This sets China up as lender of last resort with the negotiations already done.

Shortly the client states of the United States may approach default. California is potentially the largest but an editorial in the Wall Street Journal suggests New York might be first. And then there are Illinois, Michigan and New Jersey each on the verge. However it unfolds the Federal Government’s balance sheet is in no shape for bailouts and it is unlikely a Republican congress will take kindly to blue states asking for financial support.

As Chairman Bernanke continues to leverage the balance sheet of the Federal Reserve, it will only take a singular moment of fear to lead to panic sending interest rates higher, or a push of the button on a computer keyboard for capital, now leaving the United States at a modest pace, to flee.

In a year end interview on Bloomberg Television Bill Gross, head of Pimco said, “The present is a good time to get out of the dollar and into currencies that hold value going forward…”

When the raiders of the currency come over the wall there is no defense but to raise interest rates. And when interest rates rise default is on the doorstep.

Then the question becomes what concessions do we make and how much will we have to pay for China’s International Investment Fund to buy our debt.